TUTORIAL: EXPLORATORY DATA ANALYSIS

An introduction to data manipulation and analysis in R

“The goal is to turn data into information and information into insight.” – Carly Fiorina, former chief executive officer, Hewlett Packard.

INTRODUCTION

If you are familiar with data analysis then I’m certain that you fully relate to the above statement. After all, it would be pointless to play around with lots of data just for the love of it, sometimes not but you get the point.

Data is gold, and the more you have the better off you are. However, raw unprocessed data is of no use unless you manipulate and gain insights from it. Before embarking on say statistical modelling and visualization of your data, it is very important to first have an understanding of the data itself. Exploratory Data Analysis (EDA) aids in visualization, transformation, and generally cleaning or remodeling data before diving deep into information extraction.

There are no set rules to be followed when performing EDA. As a data preparation phase, one is allowed to decide what suits them best in order to gain an understanding of their data. However, there are two most important questions one should seek to answer while studying their data:

- Is there variation within my variables?

- Is there any correlation between my variables?

That being said, EDA involves the following checks among others:

- Descriptive Statistics - Gives a summarized understanding of the data, usually as measures of central tendency and variability.

- Mean - Arithmetic average

- Median - middle value

- Mode - most frequent value

- Standard Deviation - variation from the mean

- Kurtosis -peakedness of the data distribution

- Skewness - symmetry of the data distribution

- Groupings of data

- Missing values

- ANOVA: Analysis of variance

- Graphical visualization, not restricted to:

- Histogram -frequency bar plots

- Density estimation - an estimation if the frequency distribution based on sample data

- Box plots - A visual representation of median, quantiles, symmetry and ourtliers

- Scatter plots - a graphical display of variables plotted on the x and y axes.

In this post, we will perform EDA on a sample data set containing responses to a mobile banking survey in Kenya. If you would like to follow along with the same data, you can download it here.

DATA IMPORTATION

The code chunk below imports our data set into R.

#Loading Data into R toc_depth: 2

mobileBanking.Df <- read.csv("J://Personalprojects//Blogsite//data//MobileBankinginKenya.csv", header = TRUE, stringsAsFactors = FALSE )

mobileBanking.Df <- mobileBanking.Df[,-1] #Remove the number column which is Irrelevant1.0.0 Data Inspection

Once our sample data set is loaded, we check for features present. We first need to load all the libraries needed for data analysis and manipulation.

#Load required packages or install if not present.----

load.libraries <- c('data.table','tidyverse','gridExtra', 'corrplot', 'GGally', 'ggplot2', 'e1071', 'dplyr')

install.lib <- load.libraries[!load.libraries %in% installed.packages()]

for(libs in install.lib) install.packages(libs, dependences = TRUE)

#Load libraries and flag TRUE

sapply(load.libraries, require, character = TRUE)The function above takes in a list of required libraries, checks if they are already installed and installs them if not. It then loads all the packages one at a go.

1.1.0 Observing the data structure

dim(mobileBanking.Df)

## [1] 43 11The data set has 43 rows with 11 Variables. We therefore explore the data types of each variable/column.

#Check Categorical VS Numeric Characters----

cat_vars <- names(mobileBanking.Df)[which(sapply(mobileBanking.Df, is.character))]

cat_vars

## [1] "Gender" "Age.Range"

## [3] "Have.Bak.Account" "Bank.account.connected.to.MB"

## [5] "MB.used.for" "Importance"

## [7] "Benefit" "Bank.Visit"

## [9] "MB.Safety" "Influence"

## [11] "Satisfaction"

numeric_vars <- names(mobileBanking.Df)[which(sapply(mobileBanking.Df, is.numeric))]

numeric_vars

## character(0)To identify the data types, we can check for numeric and categorical variables present in the data. In our case, all the variables in our data set are categorical. We will therefore explore the data from a categorical approach rather than numeric. There exists different visualization methods for different data types. Now that we have established the general structure of the data, we can check for missing values, NAs.

#Checking data for any missing values

colSums(sapply(mobileBanking.Df, is.na))

## Gender Age.Range

## 0 0

## Have.Bak.Account Bank.account.connected.to.MB

## 0 0

## MB.used.for Importance

## 0 0

## Benefit Bank.Visit

## 0 0

## MB.Safety Influence

## 0 0

## Satisfaction

## 0We have no columns with missing values in our data. We can therefore proceed to analysis without worrying about missing values. In a case whereby there exists NA values, one can choose whether to replace the nulls with the most appropriate values or remove the rows with nulls from the data. This is important for later stages of analysis that include data modelling, like Machine Learning.

1.1.1 Data Summary

#Data Summary----

summary(mobileBanking.Df)

## Gender Age.Range Have.Bak.Account

## Length:43 Length:43 Length:43

## Class :character Class :character Class :character

## Mode :character Mode :character Mode :character

## Bank.account.connected.to.MB MB.used.for Importance

## Length:43 Length:43 Length:43

## Class :character Class :character Class :character

## Mode :character Mode :character Mode :character

## Benefit Bank.Visit MB.Safety

## Length:43 Length:43 Length:43

## Class :character Class :character Class :character

## Mode :character Mode :character Mode :character

## Influence Satisfaction

## Length:43 Length:43

## Class :character Class :character

## Mode :character Mode :characterThe base R Summary() function comes in handy at summarizing data. In our case, there is no statistical measures since all our variables are categorical. Note that the function also specifies the specific data types. There are more than enough ways to inspect data structures in R.

2.0.0 Getting Insights from the data

2.1.0 Descriptive Statistics For Categorical Data

The main goal of descriptive statistics is to inform data analysts on the main features of either numerical or categorical data, using sample summaries represented as either tables, individual numbers or charts and graphs. Since we only have categorical data, I will illustrate the most used forms of descriptive statistics for the same. However, like I mentioned earlier, there are more than enough ways to analyze data in R.

2.1.1 Frequencies

Frequencies illustrate the number of occurrences or observations of a particular category in data. We use contigency tables to present this information. In R this can be achieved using the table() function.

From out data, the total distribution of respondents based on gender looks like this;

#Gender frequencies

#library(kableExtra)

table(mobileBanking.Df$Gender)

##

## Female Male

## 20 23We can illustrate multiple attributes using cross classification tables such as;

#library(kableExtra)

# Cross classification counts for gender by Mobile banking safety opinion

table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety)

##

## NotAtAll Somewhat Very

## Female 3 11 6

## Male 0 19 4Multidimensional tables with three or more categories can also be achieved using the ftable() . As an example, let’s check out the number of respondents based on gender, mobile banking safety opinion and how often they visit the bank.

#Counts by gender, opinion and bank visits

table_ <- table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety, mobileBanking.Df$Bank.Visit)

ftable(table_)

## FewTimesAyear OnceMonth

##

## Female NotAtAll 3 0

## Somewhat 11 0

## Very 5 1

## Male NotAtAll 0 0

## Somewhat 15 4

## Very 4 02.1.1 Proportions

Proportions are basically contingency tables represented as percentages. From our previous tables, we can do proportions for the same by applying prop.table() to output produced by the *table() function. Proportions for the above will then be;

#library(kableExtra)

#Gender frequencies proportions

prop.table(table(mobileBanking.Df$Gender))

##

## Female Male

## 0.4651163 0.5348837

#Percentage idistribution for Gender by mobile banking safety

prop.table(table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety))

##

## NotAtAll Somewhat Very

## Female 0.06976744 0.25581395 0.13953488

## Male 0.00000000 0.44186047 0.09302326

#Percentage by gender, opinion and bank visits, rounding off to 2 decimal places

table_ <- table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety, mobileBanking.Df$Bank.Visit)

ftable(round(prop.table(table_),2))

## FewTimesAyear OnceMonth

##

## Female NotAtAll 0.07 0.00

## Somewhat 0.26 0.00

## Very 0.12 0.02

## Male NotAtAll 0.00 0.00

## Somewhat 0.35 0.09

## Very 0.09 0.002.1.2 Marginals

Marginals measure counts across columns or rows in a contingency table. Margin.table() gives us the frequencies while prop.table() gives us the percentages. Using our previous examples on frequencies;

# FREQUENCY MARGINALS

# row marginals - totals for each gender across mobile banking opinion

margin.table(table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety), 1)

##

## Female Male

## 20 23

# colum marginals - totals for each gender across mobile banking opinion

margin.table(table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety), 2)

##

## NotAtAll Somewhat Very

## 3 30 10

# PERCENTAGE MARGINALS

# row marginals - row percentages across gender

prop.table(table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety), margin = 1)

##

## NotAtAll Somewhat Very

## Female 0.150000 0.550000 0.300000

## Male 0.000000 0.826087 0.173913

# colum marginals - column percentages acrossmobile banking opinion

prop.table(table(mobileBanking.Df$Gender, mobileBanking.Df$MB.Safety), margin = 2)

##

## NotAtAll Somewhat Very

## Female 1.0000000 0.3666667 0.6000000

## Male 0.0000000 0.6333333 0.40000002.2.0 Visualizing Distributions

The code chunk bellow is a function that takes in our data set and plots all the present variables in it. Since we have categorical variable only, we will use bar plots for visualization. They are the most appropriate for categorical data.

#Loading Data into R toc_depth: 2

mobileBanking.Df <- read.csv("J://Personalprojects//Blogsite//data//MobileBankinginKenya.csv", header = TRUE, stringsAsFactors = FALSE )

mobileBanking.Df <- mobileBanking.Df[,-1] #Remove the number column which is Irrelevant

#Check Categorical VS Numeric Characters----

cat_vars <- names(mobileBanking.Df)[which(sapply(mobileBanking.Df, is.character))]

numeric_vars <- names(mobileBanking.Df)[which(sapply(mobileBanking.Df, is.numeric))]

####Convert character to factors----

library(data.table)

setDT(mobileBanking.Df)[,(cat_vars) := lapply(.SD, as.factor), .SDcols = cat_vars]

mobileBanking.Df_cat <- mobileBanking.Df[,.SD, .SDcols = cat_vars]

##mobileBanking.Df_cont <- mobileBanking.Df[,.SD,.SDcols = numeric_vars]

#Functions for Plots---

library(ggplot2)

library(gridExtra)

plotHist <- function(data_in, i) {

data <- data.frame(x=data_in[[i]])

p <- ggplot(data=data, aes(x=factor(x))) + stat_count() + xlab(colnames(data_in)[i]) + theme_light() +

theme(axis.text.x = element_text(angle = 90, hjust =1))

return (p)

}

doPlots <- function(data_in, fun, ii, ncol=3) {

pp <- list()

for (i in ii) {

p <- fun(data_in=data_in, i=i)

pp <- c(pp, list(p))

}

do.call("grid.arrange", c(pp, ncol=ncol))

}

plotDen <- function(data_in, i){

data <- data.frame(x=data_in[[i]], SalePrice = data_in$SalePrice)

p <- ggplot(data= data) + geom_line(aes(x = x), stat = 'density', size = 1,alpha = 1.0) +

xlab(paste0((colnames(data_in)[i]), '\n', 'Skewness: ',round(skewness(data_in[[i]], na.rm = TRUE), 2))) + theme_light()

return(p)

}Variable Distributions

#Plotting categorical values----

#Bar plots

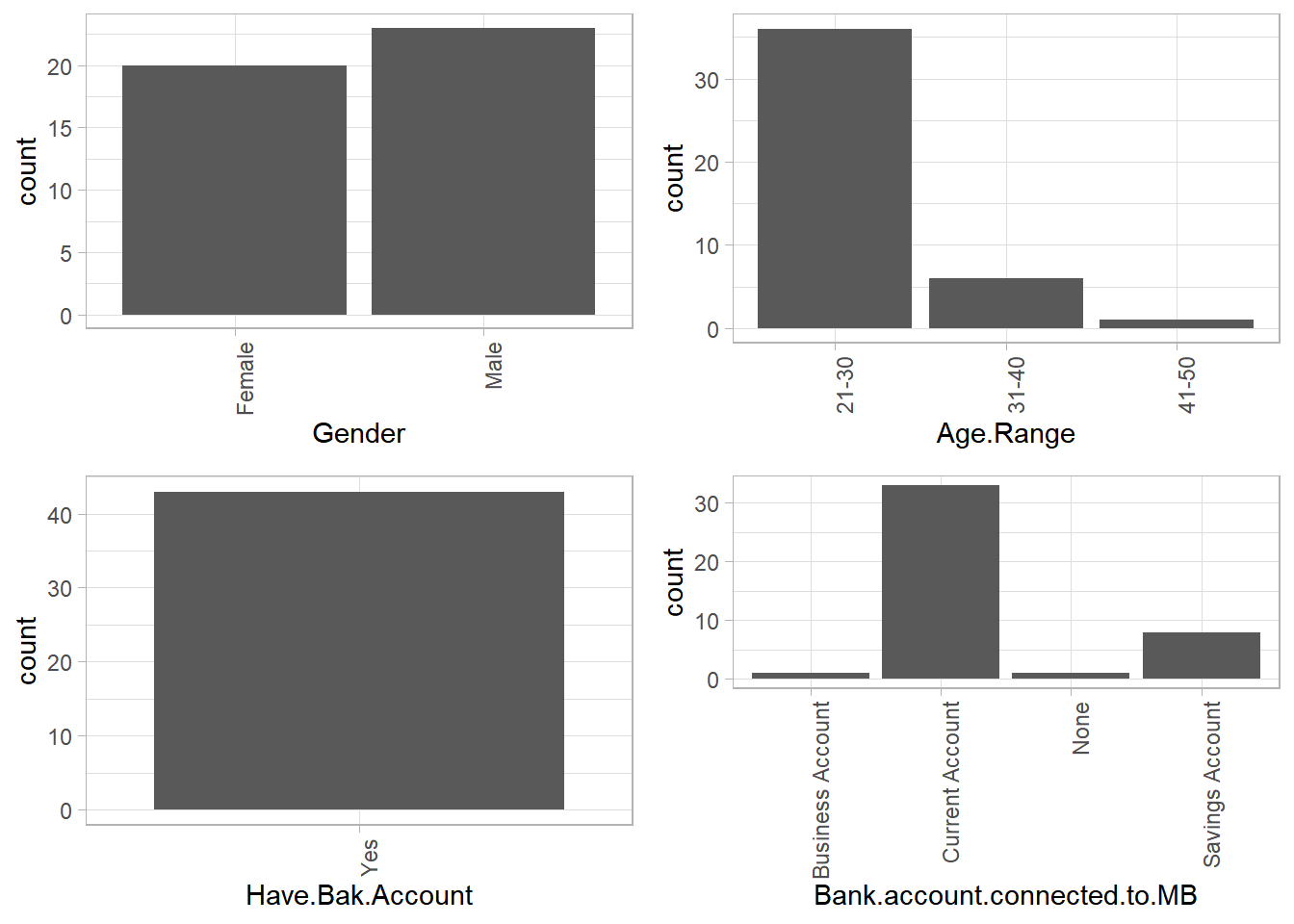

doPlots(mobileBanking.Df_cat, fun = plotHist, ii = 1:4, ncol = 2)

Gender

It can be seen that a larger number of respondents were male, this is however by a small margin. If we had a larger data set we could have more female respondents.

Age Range

A majority of respondents were younger guys between age 21-30, followed by the 31-40 age bracket. The least respondents were those above age 41. This could be probably because the older people chose not to participate in the survey as opposed to the younger ones, or that they somehow never got to opportunity to do so. A good example is the medium by which the survey was conducted, which the older people didn’t have.

Have Bank Account & Linked To Mobile Banking

All the respondents had bank accounts. A very small number had their business bank accounts linked to mobile banking. Majority had linked their current accounts probably due to the convenience that comes with mobile banking like frequent or timeless withdrawals.

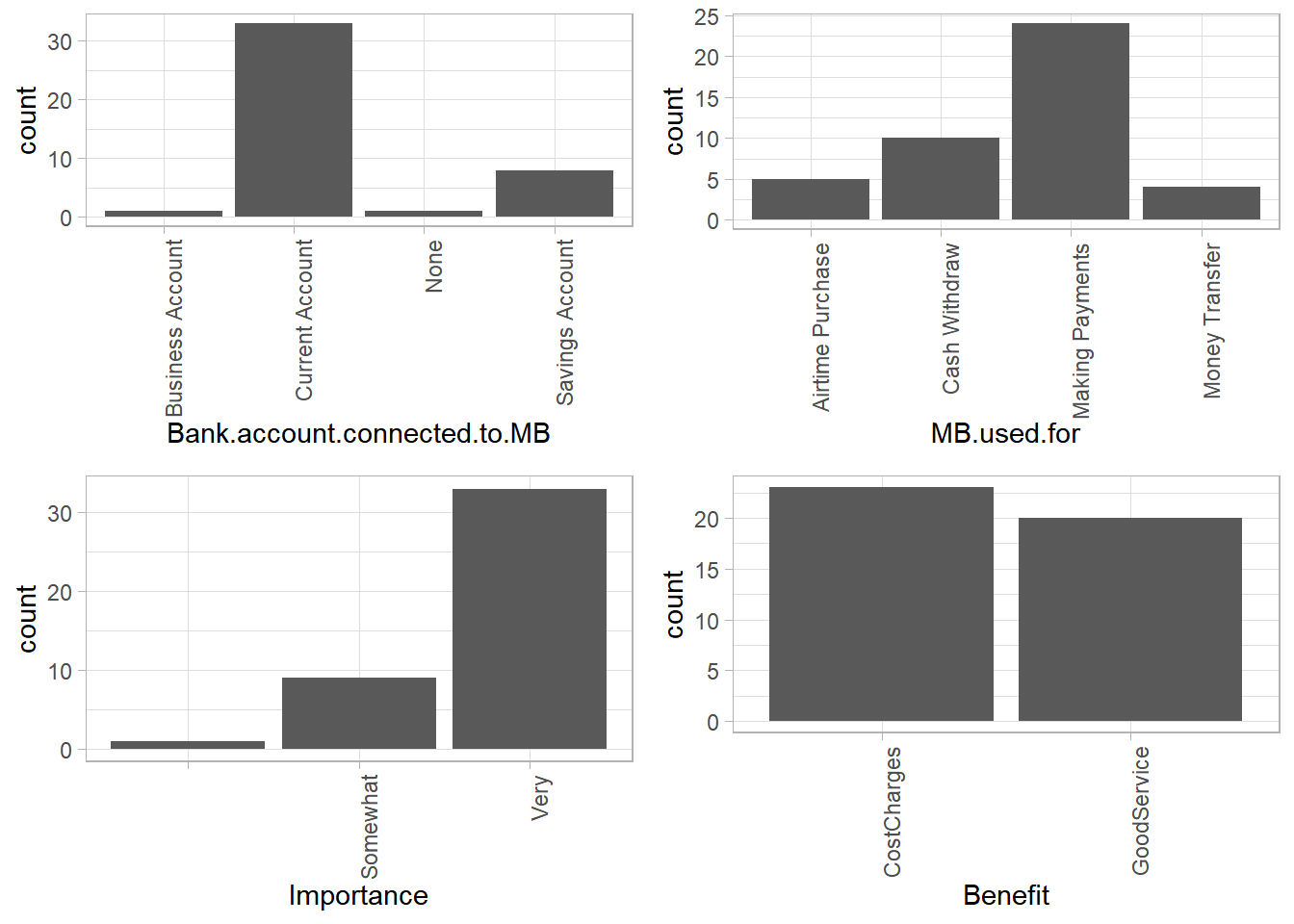

Uses Of Mobile Banking, Importance And Benefits

Most respondents use mobile banking services for making payments. This is followed by cash withdrawals. Airtime purchase and money transfer happen to be the least uses for the service. This could be because they are easily accessible needs unlike cash withdrawal and making payments in terms of mobility convenience.

Most respondents found mobile banking services very important, probably owing to the affordable cost charges and good service which could mean less usability issues when using the services.

Bank Visits

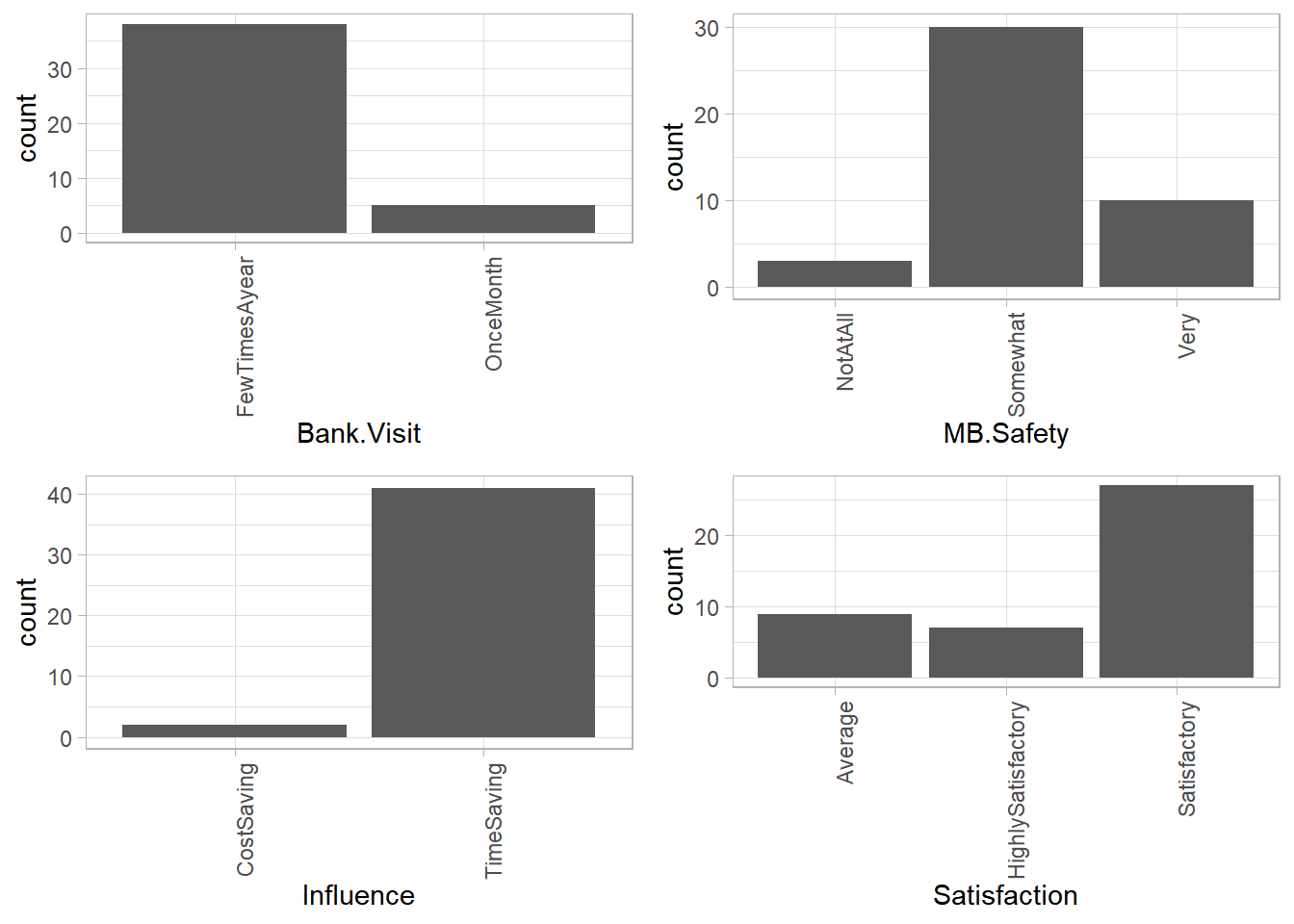

We had most users who visit their banks a few times a year while the least do it once a month. This means that generally, fewer people visit the bank physically. This could be a major impact of mobile banking services.

Mobile Banking Safety, Influence And Satisfaction

Despite being majorly satisfied by the services, most respondents did not find mobile banking services very safe. It is also seen as time saving which is probably why we had very few bank visits in general.

Conclusion from variable distributions

It can be concluded that mobile banking is mainly preferred by younger people, a majority being of the male gender. However, the only benefit most users find from mobile banking seems to be the convenience it brings. Safety is still a major concern.

That’s basically it for exploratory data analysis. I made sure to cover the basics, meaning there’s still much to be added on to this; more visualizations, packages that simplify the whole process etc…This is to be continued. For a detailed documentation on the same, here’s Hadley Wickham’s R for Data Science book you can use as a reference point.